Content

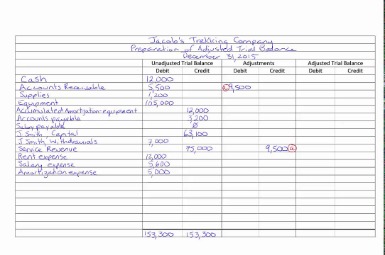

As evidenced by this example, the sum of the debit amounts is equal to the sum of the credit amounts, thus verifying that all entries have been correctly recorded. Furthermore, it is a valuable tool in preparing financial statements such as balance sheets and income statements. A WTB is a report that provides a snapshot of all the accounts in an accounting system. It ensures that the debits equal the credits before closing out entries and reporting financial statements at the end of an accounting period. The left side of a trial balance contains the company’s list of accounts, which are usually organized by account number.

- Closing temporary accounts is an important step in the accounting cycle, and running the post-closing trial balance helps to make sure that the process has been completed accurately.

- Accounting software will generate a post-closing trial balance with a click of the mouse.

- This means that revenue and expense accounts, which are closed to retained earnings during period-end close procedures, should show no balance in a post-closing trial balance.

- A trial balance is a report that lists the ending account balances in your general ledger.

- The post-closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances, which should net to zero.

Coming back to the concept ofTrial Balanceit is a listing of all balances of all accounts used in the accounting to classify financial data. This listing is divided into debit & credit columns, i.e. debit balance are showed in the separate column from credit balances. A post-closing trial balance is, as the term suggests, prepared after closing entries are recorded and posted.

Unadjusted trial balance

They are prepared at different stages in the accounting cycle but have the same purpose – i.e. to test the equality between debits and credits. A trial balance can be used to detect any mathematical errors that have occurred in a double entry accounting system. Since most trial balances do not list accounts with zero balances, the post-closing trial balance will include only general ledger balance sheet accounts having balances other than $0.00. The debit and credit amount columns will be summed and the totals should be identical. The financial information, which is classified and grouped in the various ledger accounts, is now totaled for each account.

This makes a description of the type of trial balance that is being prepared even more crucial to a trial balance user. So total value of column for debits post closing trial balance definition and total value of column for credit balances. Then the last step we will e comparing those amounts we will need to have a balance so and the quality here.

How a Trial Balance Works

The post-closing trial balance, the last step in the accounting cycle, helps prepare your general ledger for the new accounting period. It closes out balances in both expense and revenue accounts, which allows you to start tracking these totals again in the new accounting period. The basic purpose of preparing a trial balance is to test the arithmetical accuracy of the ledger. If all debit balances listed in the trial balance equal the total of all credit balances, this shows the ledger’s arithmetical accuracy. Once a book is balanced, an adjusted trial balance can be completed. This trial balance has the final balances in all the accounts, and it is used to prepare the financial statements.

An adjusted trial balance is a document accountants use to ensure the accuracy and completeness of an organization’s books. After adjusting, a working trial balance lists all the accounts in an entity’s general ledger, with their respective debit and credit balances. Until computers became available in business, the only way to check the accuracy of the books was manually prepare a trial balance which involved listing all ledger accounts and their balances. This manual process was slow and tedious and prone to errors due to human fatigue or miscalculations.

Using the Adjusted Trial Balance

It also required accountants to keep meticulous records, as any changes would involve going through every entry again. The WTB also shows account numbers, account titles, and balance amounts. It is a valuable tool for double-checking to ensure an organization’s financial records are accurate before producing summary financial statements.

In many companies, accounts are numbered starting with asset accounts and move through liability, equity, revenue and expense accounts, in that order. However, some companies begin with revenue accounts and move to expenses and the balance sheet accounts. Whatever method of organization the company chooses, the trial balance accounts will be listed in a consistent order each time the report is created. The post-closing trial balance for ABC Consulting Inc. is presented in the screenshot below.

So if there are already two other trial balance reports, why would you possibly need another one? The post-closing trial balance shows the final balance in company accounts for the current accounting period, which are the exact same balances that the accounts have in the beginning of the next accounting period. In addition to error detection, the trial balance is prepared to make the necessary adjusting entries to the general ledger. It is prepared again after the adjusting entries are posted to ensure that the total debits and credits are still balanced. It is usually used internally and is not distributed to people outside the company.

In conclusion, the Working Trial Balance is a critical tool for business owners and accountants. This accounting process helps to ensure accuracy in bookkeeping by providing a snapshot of all ledger accounts up to date in real time. Errors can then be corrected to ensure compliance with Generally Accepted Accounting Principles . After adjusting, a new adjusted trial balance is created to generate formal financial reports such as an income statement or balance sheet. And just like any other trial balance, total debits and total credits should be equal.

The next we will be calculating total value of debit balances and total value of credit balances. The trial balance worksheet contains columns for both income statement and balance sheet entries, allowing you to easily combine multiple entries into a single amount. This makes sure that your beginning balances for the next accounting cycle are accurate. Each account’s total debit or credit amount will be listed on this statement, as well as their overall totals.

Rebekiah received her BBA from Georgia Southwestern State University and her MSM from Troy University. She has experience teaching math to middle school students as well as teaching accounting at the college level. She has a combined total of twelve years of experience working in the accounting and finance fields. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.